Table of Content

Eligible Veterans, service members, and survivors with full entitlement no longer have limits on loans over $144,000. This means you won’t have to pay a down payment, and we guarantee to your lender that if you default on a loan that’s over $144,000, we’ll pay them up to 25% of the loan amount. VA Guaranty Amount Varies with the size of the loan and the location of the property. Because lenders are able to obtain this guaranty from VA, borrowers do not need to make a down payment, provided they have enough home loan entitlement.

A VA guaranteed home loan offers a number of safeguards and advantages over a non VA guaranteed loan. For example, the interest rate is competitive with conventional rates with little or no down payment required. A VA guaranteed home loan is made by private lenders, such as banks, savings and loan associations, and mortgage companies.

Post-World War II period

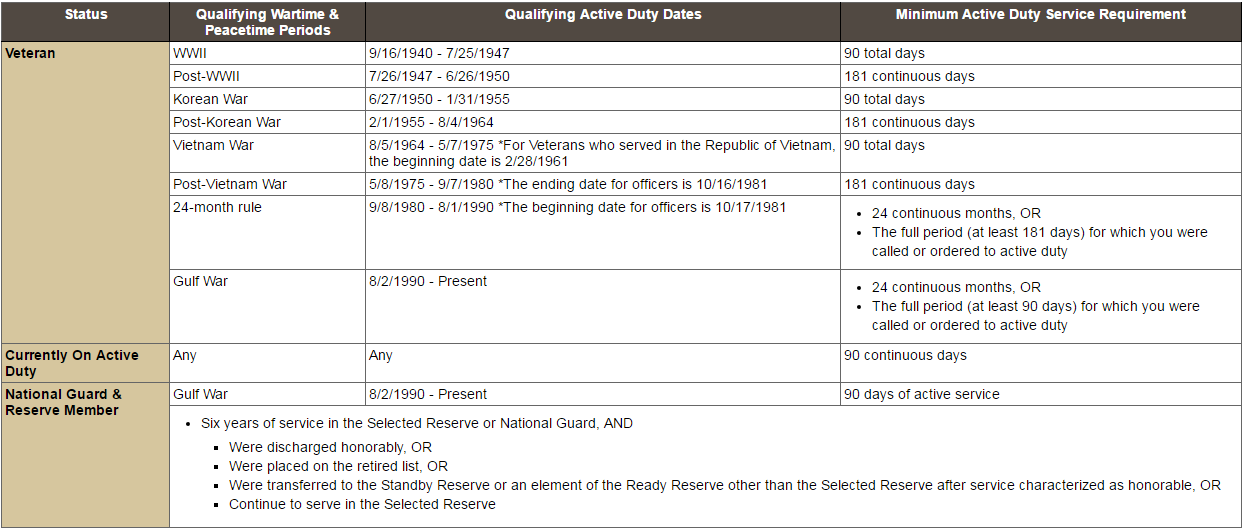

You must have at least 90 days on active duty and been discharged under other than dishonorable conditions to qualify for a VA guaranteed home loan. If you served less than 90 days, you may be eligible if discharged for a service connected disability. Reservists and National Guard members are eligible if they were activated after Aug. 1, 1990, served at least 90 days, and received an honorable discharge. And as it relates to closing costs, veterans are limited to the types of closing costs they can pay. Veterans can pay for an appraisal report, credit report, title work, recording fees and origination charges. Prospective borrowers can always contact a loan officer and get a copy of estimated closing costs for their situation.

A funding fee must be paid to VA unless the Veteran is exempt from such a fee. Closing costs such as VA appraisal, credit report, loan processing fee, title search, title insurance, recording fees, transfer taxes, survey charges, or hazard insurance may not be included for purchase home loans. For example, for a first time veteran buyer is 2.15 percent of the sales price for a zero money down VA home loan for a veteran or eligible active duty service member. If that same borrower were to make a 5.0 percent down payment, the funding fee drops to 1.50 percent of the sales price. A larger category of VA loans exists and is named so for its size ---Jumbo.

Program Description

The largest guaranty that VA can give is an amount equal to 25% of the Freddie Mac conforming loan limit for single-family residences. Veterans may also choose a different type of adjustable rate mortgage called a hybrid ARM, where the initial interest rate remains fixed for three to 10 years. If the rate remains fixed for less than five years, the rate adjustment cannot be more than one percent annually and five percent over the life of the loan. For a hybrid ARM with an initial fixed period of five years or more, the initial adjustment may be up to two percent. The Secretary has the authority to determine annual adjustments thereafter. Currently annual adjustments may be up to two percentage points and six percent over the life of the loan.

You can purchase a condo instead of a house with a VA loan, learn more about loan qualifications and the benefits of buying a... To find out how much the guarantee will be on your VA loan, contact an approved lender.You can get free VA loan offers here. Proportionately speaking, loans under $144,000 can get a larger guarantee. As much as half of a VA loan under $45,000 can be guaranteed. The proportion of VA guarantee goes down as the amount of the loan goes up. When you obtain a Certificate of Eligibility for the first time, you may notice that your available entitlement is $36,000.

Guaranty Remittance Benefits

Veterans who wish to refinance their subprime or conventional mortgage may now do so for up to 100 percent of value of the property. Veteran borrowers may be able to request relief pursuant to the Servicemembers Civil Relief Act . In order to qualify for certain protections available under the Act, their obligation must have originated prior to their current period of active military service. SCRA may provide a lower interest rate during military service and for up to one year after service ends, provide forbearance, or prevent foreclosure or eviction up to nine months from period of military service. Loans made prior to Mar. 1, 1988, are generally freely assumable, but Veterans should still request the lender’s approval in order to be released of liability.

Give me more benefit content and other military content to my inbox. Bankruptcy and foreclosure can take a toll on your financial profile. The U.S. Department of Veterans Affairs guarantees a generous portion of each VA loan. How much the VA guarantee ends up being depends on the loan amount. Lenders will submit a request for remittance through the Guaranty Remittance API and receive a response that indicates successful connection. The Veteran can prepay without penalty the entire loan or any part not less than one installment or $100.

The amounts may vary depending on the size of the loan and location of the property. VA does not have the authority to take a second-lien position on a property. In the case of disaster, the Secretary may guarantee a loan whether or not it is a second lien through a public entity providing disaster assistance. The borrower obtaining a loan may only be charged closing costs allowed by VA. How to secure a VA loan and all of the benefits that go along with it in an easy, step by step guide for active duty...

If approved, the purchaser will have to pay a funding fee that the lender sends to VA, and the Veteran will be released from liability to the federal government. VA home loan guaranties are issued to help eligible Servicemembers, Veterans, Reservists, National Guard members, and certain surviving spouses obtain homes, condominiums, and manufactured homes, and to refinance loans. For additional information or to obtain VA loan guaranty forms, visit /homeloans/.

The VA has established lending guidelines that make it easier for a veteran or active duty service member to buy and finance a home to live in. Buyers don’t have to come up with a down payment which keeps many buyers on the sidelines longer when trying to save up enough money for a down payment and closing costs. Not having to jump over that hurdle is a big plus for veterans. An eligible borrower can use a VA-guaranteed Interest Rate Reduction Refinancing Loan to refinance an existing VA loan to lower the interest rate and payment.

The guarantee is in favor of the lender but is paid for by the borrower in the form of a mortgage insurance policy. A mortgage insurance policy doesn’t cover making monthly payments should the borrowers be unable to pay for some reason but does provide the lender with some compensation should the loan ever go into foreclosure. This mortgage insurance policy is simply referred to by lenders as the VA Home Loan Guarantee and is financed by what is known as the Funding Fee. There are several reasons why VA approved mortgage lenders appreciate VA home loan applicants. Such lenders appreciate their service to their country and do what they can in return.

No comments:

Post a Comment